Property value is an important concept for anyone who owns or is interested in buying or selling a property. It refers to the estimated worth of a real estate property, and it is determined by a variety of factors, such as the property’s location, size, condition, and the overall state of the real estate market.

Property value is important for several reasons, but let’s talk about three of them.

1

Firstly, it can be used to determine how much a property is worth on the open market. This information is crucial for anyone who is interested in buying or selling a property, as it helps to establish a fair price for the property in question. For example, if a seller is asking for a price that is significantly higher than the estimated property value, a buyer may be able to negotiate a better deal or look for other options.

2

Secondly, property value is important because it can have a significant impact on a property owner’s financial situation. For instance, if a property’s value increases, the owner may be able to take out a larger mortgage or refinance the property at a lower interest rate. Conversely, if a property’s value decreases, the owner may have difficulty obtaining financing or may be forced to sell the property at a loss.

3

Thirdly, property value is important because it can affect a property owner’s tax liability. In many countries, property taxes are based on the assessed value of the property. This means that if a property’s value increases, the owner may be required to pay more in property taxes. Conversely, if the property’s value decreases, the owner may be able to pay less in property taxes.

In the context of accessory dwelling units (ADUs), property value is also an important consideration for homeowners who are looking to add an ADU to their property. ADUs can increase the value of a property, providing additional living space or rental income, but the impact on property value will depend on a number of factors, such as the size, location, and quality of the ADU.

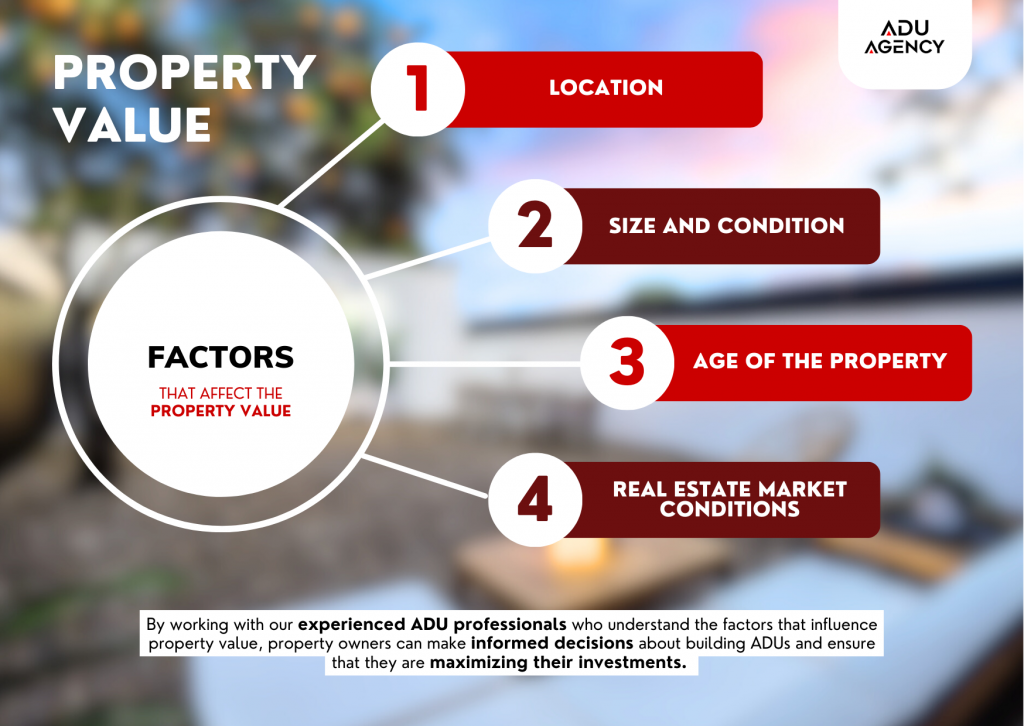

Factors that Affect Property Value

There are many factors that can influence the value of a property. Some of the most significant factors include the following:

1. Location: The location of a property is perhaps the most important factor that affects its value. Properties located in desirable neighborhoods or near amenities like schools, parks, and shopping centers tend to be worth more than properties located in less desirable areas.

2. Size and Condition: The size and condition of a property are also important factors that can influence its value. Larger properties with more bedrooms and bathrooms are generally worth more than smaller properties. Similarly, properties that are well-maintained and in good condition are generally worth more than properties that are in disrepair.

3. Age of the Property: The age of a property can also be a factor that affects its value. Older properties may have historic or architectural significance, which can increase their value. However, they may also require more maintenance or renovations, which can decrease their value.

4. Real Estate Market Conditions: The overall state of the real estate market can also influence property value. In a hot real estate market, properties may be in high demand, and their values may increase. Conversely, in a slow real estate market, properties may be in less demand, and their values may decrease.

We can increase the value of your property. Do you want to know how?

Why Property Value Fluctuates

Property value can fluctuate over time for several reasons. One of the most common reasons is changes in the local real estate market.

For example, if there are more buyers than sellers in a particular area, property values may increase. Conversely, if there are more sellers than buyers, property values may decrease.

Other factors that can influence property value include changes in zoning laws, improvements or declines in the local economy, and natural disasters like floods, fires, or earthquakes. Additionally, the condition of the property itself can also affect its value. If a property is in disrepair or requires significant renovations, its value may decrease. Conversely, if a property is well-maintained and updated, its value may increase.

The Importance of Accurate Property Valuations

Accurate property valuations are essential for anyone who is buying or selling a property, as well as for property owners who are interested in refinancing or obtaining financing. Inaccurate valuations can lead to a number of problems, including disputes between buyers and sellers, financial difficulties for property owners, and incorrect property tax assessments. Therefore, it is important to work with experienced real estate professionals who can provide accurate property valuations based on market trends and other relevant factors.

Property valuations are particularly important for property owners who are interested in building accessory dwelling units (ADUs). However, ADUs can also have an impact on the overall value of a property, and accurate valuations are necessary to ensure that property owners are getting a fair price for their investment. Inaccurate valuations can lead to overpricing, which can make it difficult to attract tenants or buyers, or underpricing, which can result in financial losses for the property owner.

By working with our experienced ADU professionals, at ADU Agency, who understand the factors that influence property value, property owners can make informed decisions about building ADUs and ensure that they are maximizing their investments. Accurate property valuations are a critical component of this process, and property owners should prioritize working with professionals who can provide reliable and comprehensive valuations based on market trends and other relevant factors.